food tax in maryland

Sales of grocery food are exempt from the sales tax in Maryland. The goal is to fund a state spayneuter program.

It S Tax Free Week In Maryland Now Through The 18th Shop Tax Free At All Your Favorite Shops Make Sure You V Candy Companies Candy Store Old Fashioned Candy

Everyone has the right to apply for SNAP.

. We include these in their state sales. Applicants must file an application be interviewed and meet all financial and technical eligibility factors. This would be on top of the 20 million Maryland pet owners paid in the sales tax on pet food last year.

California 1 Utah 125 and Virginia 1. However food items that are prepared for consumption on the grocers premises or are packaged for carry out are considered prepared food and are subject to a 6 sales tax. We need to enforce a junk food tax.

This thread is archived. Posted by 7 months ago. You are able to use our Maryland State Tax Calculator to calculate your total tax costs in the tax year 202122.

The Supplemental Nutrition Assistance Program SNAP formerly known as Food Stamps helps low-income households buy the food they need for good health. 2022 Maryland state sales tax. The Maryland Department of Agriculture manages the program in cooperation with the Comptroller and has authority to issue up to 100000 in tax credits annually.

This page discusses various sales tax exemptions in Maryland. For more information on this and other topics visit the University of Maryland Extension website at wwwextensionumdedu 1 Fact Sheet FS i Launching a Cottage Food Business in Maryland entrepreneurs to launch a food business without -1005 November 2015 The Cottage Food Industry Law of 2012 in Maryland opened the door for small-scale food. To learn more see a full list of taxable and tax-exempt items in Maryland.

Where Can I Get a Montgomery County Maryland FoodBeverage Tax. Is the food taxed here in Maryland. There is a proposal to create a new 1 million tax on pet food in Maryland.

This is why you wont have to pay a Maryland food tax on a box of crackers. Maryland food bank inc Copies of Returns 990 990-EZ 990-PF 990-T Electronic copies images of Forms 990 990-EZ 990-PF or 990-T returns filed. While the Maryland sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

A Maryland FoodBeverage Tax can only be obtained through an authorized government agency. Counties and cities are not allowed to collect local sales taxes. We support the program and think there are fairer ways to raise money than a new tax on responsible pet owners.

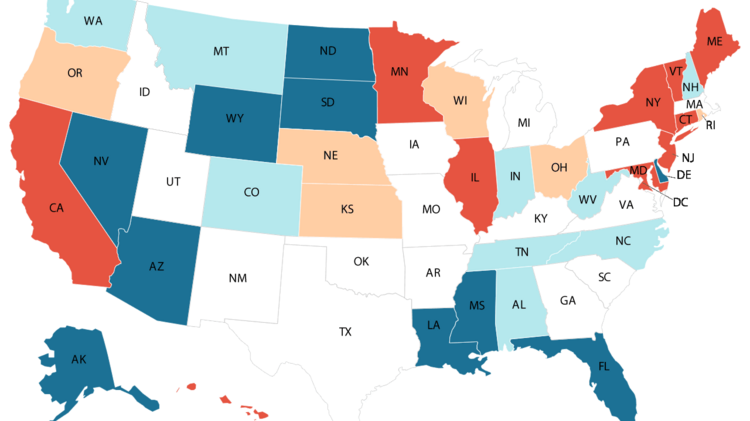

Maryland Salary Tax Calculator for the Tax Year 202122. In general food sales are subject to Marylands 6 percent sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and the food is not a taxable prepared food. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on groceries candy or soda.

In general sales of food are subject to sales and use tax unless a person operating a substantial grocery or market business sells the food for consumption off the premises and is not a taxable prepared food. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to get a Maryland FoodBeverage Tax. It will slightly increase the price of unhealthy foods and sugary drinks.

If you should have any questions please contact the Office of Food Protection at 410 767-8400. Our calculator has been specially developed in. Made by a cottage food business that is not subject to Marylands food safety regulations It is our intention that each approving authority will enforce and regulate these business consistently and uniformly as stated in the regulations.

By increasing these prices we can reduce the effects of the sugary drinks and junk food. Depending on the type of business where youre doing business and other specific regulations that may apply there may be multiple government agencies that you must contact in order to. It will not put a stop to peoples precious snacks.

Sale of food that is exempt from the state sales and use tax Under Section 11-206 of the Tax-General Article of the Annotated Code of Maryland. A grocery or market business is considered substantial if sales of grocery or market food items total at least 10 percent of all sales of food. 53 rows Table 1.

Does anyone know what items arent taxed here in MD. A Montgomery County Maryland FoodBeverage Tax can only be obtained through an authorized government agency. This includes the sale for consumption off the premises of crabs and seafood that are not prepared for immediate consumption.

Sale of food or beverage from a vending machine. A cottage food business or a home-based business is defined in the Code of Maryland Regulations COMAR 10150 3 as a business that a produces or packages cottage food products in a residential kitchen. Comptroller of Marylands wwwmarylandtaxesgov all the information you need for your tax paying needs.

And b has annual revenues from the sale of cottage food products in an amount not exceeding 25000. For example if I go grocery shopping will there be a tax rate. By a 20 increase in price I and many others think that the consumption could be reduce by 20.

Eligible donations are defined as fresh farm products for human consumption Food donations are eligible for a tax credit of up to 50 of the value of the donation not to exceed 5000 per calendar year. The Maryland state sales tax rate is 6 and the average MD sales tax after local surtaxes is 6. Code Tax-General 11-206.

However if a grocery store that falls under this category sells prepared foods that can be consumed on the premises or carried out then you will most likely pay a 6 sales tax. Exact tax amount may vary for different items. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

In the state of Maryland any voluntary gratuities that are distributed to employees are not considered to be taxable. B Three states levy mandatory statewide local add-on sales taxes. Groceries and prescription drugs are exempt from the Maryland sales tax.

Information About Sales of Food.

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms Chart State Tax

Please Wait Bookkeeping Business Small Business Tax Business Tax

If You Want To Avoid Paying Lots Of Taxes You Might Want To Steer Clear Of The Northeast And Venture Towards Th Best Places To Retire Retirement Locations Map

Coconut Cashew Rice Recipe Recipe Caramel Cake Recipe Lettuce Wrap Recipes Caramel Cake

Film And Tv Production In Usa In Details Tv Film Movie Usa Houseofcards Creativeindustries House Of Cards Creative Economy Big Move

Attorney Joe Gentile Answers Commonly Asked Questions Maryland Homeowners Have Regarding Property Taxes In 2022 Maryland Property Tax Homeowner

Menupro Menu Design Samples From Menupro Menu Software More Than Throughout Menu Template For Pages 10 Profes Menu Template Menu Design Food Menu Template

Build With Core For Tax Abatements In 2021 Landscape Products Green Initiatives Leed

Maryland Named No 2 Least Tax Friendly State By Kiplinger Baltimore Business Journal

Mpmpmom And Pops Reprint Menu1 Pop

Composition Of State And Local Tax Rev Income Tax Government Taxes Revenue

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Maryland Tax Credits Southern

Creamy Roasted Mushroom Soup Oasis Kitchen Soup And Sandwich Food Recipes

Menu Amygraudesign Menu Fresh Oysters Chicken Livers Chicken Liver Pate

Source White House Office Of Management And Budget The Post Income Tax Budgeting Receipts

Breakfast At Laytons In Ocean City Maryland Ocean City Maryland Ocean City Layton

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group